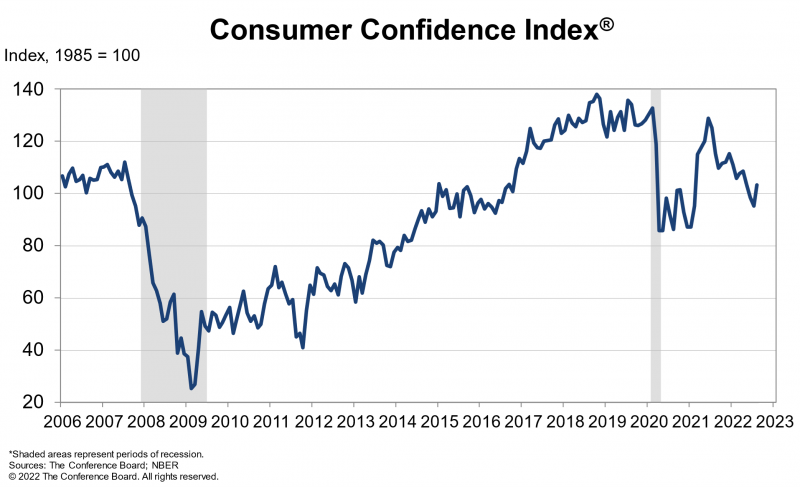

U.S. Confidence Rises – First Time in 3 Months

Overall U.S. consumer confidence rose over 8% month-to-month in August. Attitudes about current conditions moved higher for the first time since March.

BOSTON – The Conference Board Consumer Confidence Index increased in August after three consecutive monthly declines. The Index now stands at 103.2, up from 95.3 in July, an 8.3% rise.

The Present Situation Index – based on consumers’ assessment of current business and labor market conditions – improved to 145.4 from 139.7 last month (4.1%). The Expectations Index – based on consumers’ short-term outlook for income, business, and labor market conditions – increased to 75.1 from 65.6 (14.5%).

“The Present Situation Index recorded a gain for the first time since March,” says Lynn Franco, senior director of economic indicators at The Conference Board. “The Expectations Index likewise improved from July’s 9-year low but remains below a reading of 80, suggesting recession risks continue.”

Franco says inflation concerns eased a bit, but they remain elevated.

“Meanwhile, purchasing intentions increased after a July pullback, and vacation intentions reached an 8-month high,” says Franco. “Looking ahead, August’s improvement in confidence may help support spending, but inflation and additional rate hikes still pose risks to economic growth in the short term.”

Present situation

- 19.2% of consumers said business conditions were “good,” up from 16.3%

- 23.2% said business conditions were “bad,” down from 24.2%

- 48.0% said jobs were “plentiful,” down from 49.2%.

- But 11.4% said jobs were “hard to get,” down from 12.4%.

Expectations six months in the future

- 17.5% of consumers think business conditions will improve, up from 13.7%

- 22.3% expect business conditions to worsen, down from 26.2%

- 17.4% expect more jobs to be available, up from 15.1%

- 19.3% anticipate fewer jobs, down from 21.1%

- 15.8% expect their incomes to increase, up from 15.3%

- 14.5% expect their incomes will decrease, down from 15.5%

Toluna conducts the monthly Consumer Confidence Survey for The Conference Board. The cutoff date for the preliminary results was August 23.

© 2022 Florida Realtors®